- 14

- Mar

“Paper Carrier Tape”, a magician who can make money

—Introduction of the Jiemei Technology in China

Today, we want to study another enterprise “Jiemei technology” at the upstream material end of electronic components. Jiemei technology is a listed company located in Anji, Zhejiang Province. In my opinion, it plays a very important role in the field of electronic component manufacturing. It is a company that must be studied in the research of electronic component industry.

Jiemei technology takes the thin carrier tape of electronic components as its main business, and its specific products include paper carrier tape, adhesive tape, plastic embossed carrier tape and release film. Maybe many friends, like me, feel a little confused when they first see the company’s main business. Many people will not know what the company’s “thin carrier tape” specifically refers to, especially when it involves paper, tape and film

As the saying goes, if you are ignorant of the company and its products, you can’t understand the connotation of the company, and all kinds of research is even more impossible. So today I want to share my basic research on Jiemei technology. I hope to discuss and make progress with friends who see this article

【Thin carrier tape emerging from “Surface Mount Technology】

Before talking about the products of Jiemei technology, we should first understand the development process of electronic components, from which we can understand the background of the main products of Jiemei technology and its irreplaceable position in the production of electronic components.

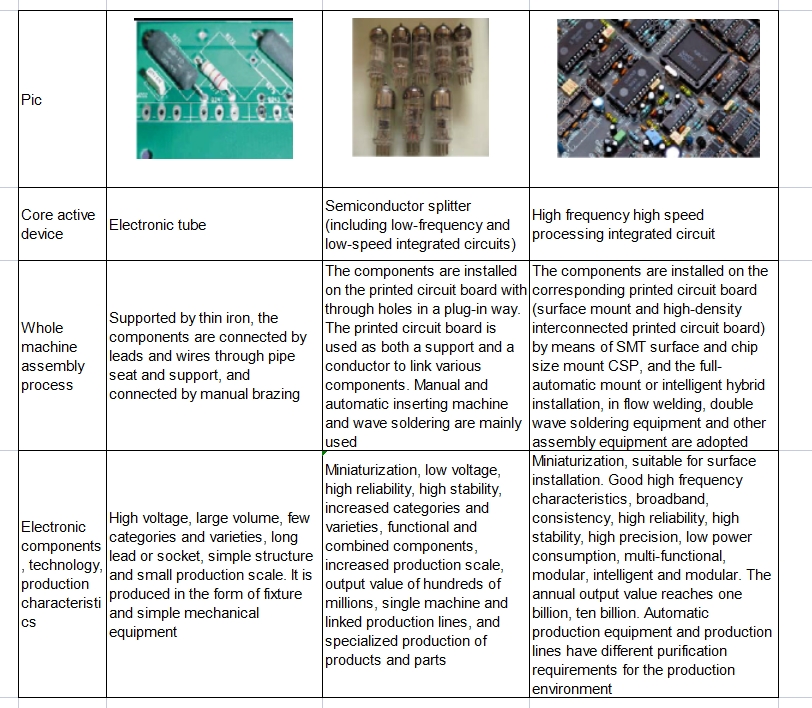

Up to now, electronic components have roughly experienced three stages: classical electronic components stage, miniaturized electronic components stage and microelectronic components stage.

In these three stages, the development of technology is guided by representative electronic components. Specifically, in the first stage, the bulky electronic tube is used as the core and processed by manual brazing;

In the second stage, semiconductor discrete devices are mainly installed on the circuit board in the form of plug-in, and manual and automatic plug-in machines are also used for welding. Due to the limitations of components and technology, it is difficult to realize large-scale automatic production of electronic components in these two stages.

Later, with the progress of technology, the third generation of miniaturized electronic components rose rapidly, and then integrated circuits began to appear.

With the miniaturization of electronic components, advanced “surface mount technology” came into being and quickly replaced the previous jack components. So far, the third generation microelectronic components have established the current dominant position.

For the three stages of the development of electronic components, please see the figure below:

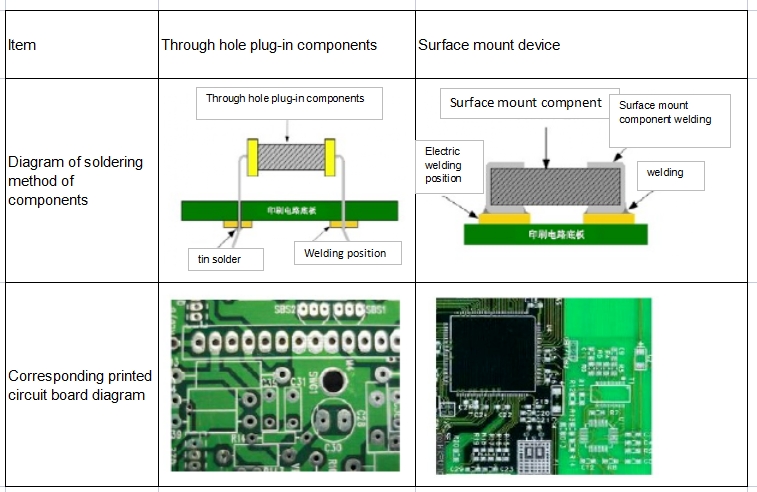

With the development of the third generation of electronic components, an important technology has emerged in the field of electronic component manufacturing, which is called “surface mount technology”. Surface mount technology is an electronic assembly technology that uses automatic assembly equipment to mount and weld surface mount components to the designated position on the surface of printed circuit board. At present, it is used in almost all the production processes of electronic products. Compared with the traditional plug-in components in the past, this technology has the advantages of low cost, high efficiency and effectively reducing the volume of printed circuit board. Please see the figure below to compare the surface mount technology with the traditional through-hole plug-in components in the past

Comparison diagram of plug-in components and surface mount components

Generally, chip components are used for surface mount technology. This component has small size, light weight, high installation density, and the appearance realizes standardization, serialization and consistency of welding conditions. Under the operation of high-speed chip mounter, the automation of surface mount is realized, which greatly improves the production efficiency. At present, almost all printed circuit boards adopt this technology. Driven by this technology, in order to realize the automatic production of components, thin carrier tape came into being.

【Thin carrier tape is an indispensable accessory in the automatic production process of components】

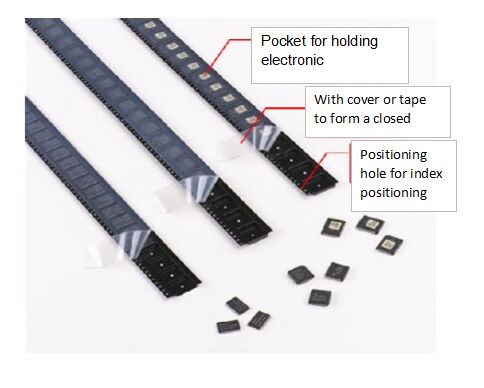

Thin carrier tape is a kind of belt product (paper tape or plastic tape) with small holes in the middle. This carrier tape has a specific thickness, and the small holes distributed on it are also specific. The thickness of carrier tape and the position and size of small holes are customized according to the specific products of downstream customers.

The main uses of thin carrier tape are reflected in two aspects: one is to protect electronic components during transportation to prevent them from pollution or damage; Second, it is used in the packaging process of electronic components, combined with tape or cover tape to realize the automatic installation of the whole packaging link. What does it look like? Please see the following figure:

Schematic diagram of thin carrier tape with upper cover tape and lower adhesive tapes

When in use, first put the components into the small pocket, and then match with the upper cover tape and lower adhesive tapes to form a sealed pocket, so as to form a closed packaging. In this way, the electronic components are very safe in the process of transportation. During production, peel off the tape or cover tape, and the automatic Mounter accurately locates through the positioning hole on the carrier belt, and then take out the components contained in the small hole, paste and install them on the printed circuit board, so as to complete the production of electronic components. Therefore, the thin carrier tape and the supporting upper and lower tapes are indispensable carriers to realize the automatic production of components. It is precisely because of its existence that the chip component packaging link has realized the installation of automation, high efficiency, high reliability and low cost.

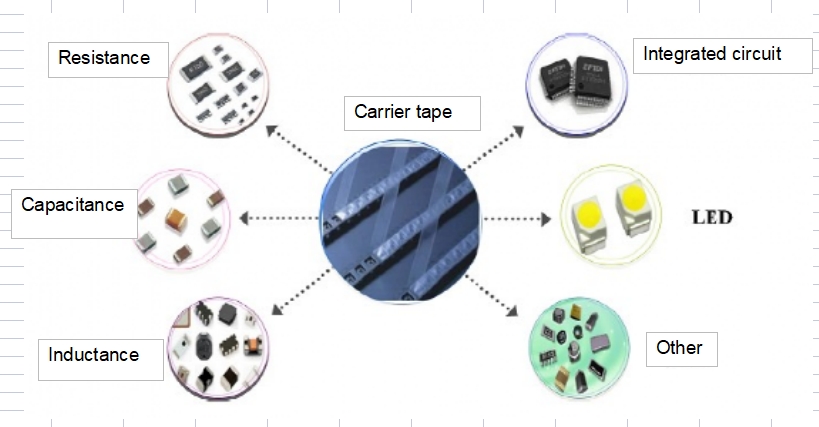

The relationship of thin carrier tape in the whole industrial chain is shown as below:

In other words, in the whole industrial chain, thin tape carrying system, electronic components and electronic information industry are interdependent and interconnected. Among them, the thin tape carrying system is at the bottom of the industrial chain and the starting point of the whole industrial chain. It is widely used in the industrial chain, with large consumption and rich specifications. Most basic electronic components, such as IC chips, resistors, inductors, capacitors, diodes and triodes, will use it. It can be said that the thin carrier belt is an indispensable accessory in the automatic production process of components, and Jiemei technology is an excellent company focusing on this field.

See the following figure for the main application fields of thin carrier tape:

From the perspective of specific products, Jiemei technology mainly has four products: paper carrier tape, plastic carrier tape, adhesive tape and release film. In fact, these four products can be divided into two categories.

The first category is composed of paper carrier tape, plastic carrier tape and adhesive tape. These three products are mainly used in the packaging field of components;

The second type is the release film launched by the company in 2018. Unlike thin carrier tape and adhesive tape, it has a wider range of applications and is the focus of the company’s future performance growth. The following section will introduce these four products in detail.

【Electronic component packaging unit composed of thin carrier tape and adhesive tape】

There are many customers in the downstream of Jiemei technology, so its products face many types of electronic components, so there are many types and specifications of supporting thin carrier tape. According to different classification standards, it has N kinds of classifications, such as according to the width of the carrier tape, according to the function, according to the material, according to the characteristics of pocket forming, etc. in order to facilitate narration and illustration, I only use the material classification to explain here.

Classified according to the different raw materials used, thin carrier tapes are mainly divided into paper carrier tapes and plastic carrier tapes. Among them, paper carrier tape is cheap and easy to recycle, which is the favorite choice of electronic component manufacturers, but it has certain constraints, that is, it can only be used for the packaging of electronic components with a thickness of no more than 1mm. When the thickness exceeds 1mm, plastic carrier tape is generally used for packaging due to the bending conditions and thickness restrictions of paper carrier tape.

In terms of the thin tape products of Jiemei technology, the paper carrier tape produced by the company mainly includes slitting paper tape, perforated paper tape and perforated paper tape,Special Cavity Paper Carrier tape,Press Pocket Paper Carrier Tape with Round Center Cavity. The appearance of the three kinds of paper tapes is shown in the figure below:

The simple understanding of slitting paper tape is that the company has simply cut the self-made electronic special paper. This paper is the most basic product of the company. Although it is the most basic, it has a high technical threshold. Like the ordinary paper we see in our daily life, it is made of wood pulp, but its surface has been treated with special glue, so there will be no dandruff. Perforated paper tape means that the holes are completely perforated. It is used with the upper and lower adhesive tapes when used. When punching, it is also treated by special technology to effectively control the generation of wool chips. The hole pressing paper tape refers to that the hole is not completely pierced, and there is no need to remove the tape when using, which can save the cost. Special technology is also adopted in the manufacturing process, and there will be no hair scraps. The above three kinds of paper tapes need to be customized according to the needs of customers

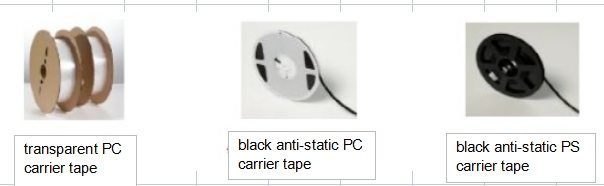

The plastic carrier tape produced by Jiemei technology mainly includes transparent PC carrier tape, black anti-static PC carrier tape, black anti-static PS carrier tape, etc. The appearance of three kinds of plastic carrier belts is shown in the figure below:

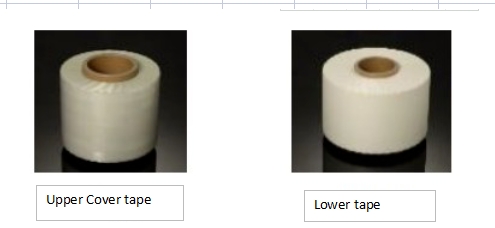

The company’s carrier tape products are divided into upper cover tape and lower tape, which are mainly used with paper carrier tape. When in use, the lower tape is bonded to the lower layer of the paper tape to prevent electronic components from sliding from the hole, then the electronic components are put into the hole of the paper tape, and finally the upper tape is covered above the paper tape to form a closed package. In the process of processing electronic components, remove the upper tape, and the automatic Mounter will accurately locate through the positioning hole on the carrier tape, and then take out the components contained in the hole, paste and install them on the printed circuit board to complete the processing. The following figure shows the tape:

Paper carrier tape is used together with adhesive tape. It is an indispensable consumable in the field of transportation, preservation and packaging of electronic components with a thickness of no more than 1mm; Plastic carrier tape is mainly used to package semiconductor separation devices, integrated circuits, LEDs and other electronic devices with a thickness of more than 1mm.

【Summary of specific conditions of thin carrier tape】

Jiemei technology has strong strength in the field of thin carrier tape. According to the information announced by the company, at present, paper carrier tape accounts for more than 50% of the industry, ranking first in the industry. Compared with the advantages of paper tape, the market share of plastic carrier tape is poor. The main reason is that plastic tape started late and its competitiveness has not been brought into play.

- In terms of paper tape, the company currently has two base paper production lines in Fuzhou, Jiangxi Province and two production lines in Anji, Zhejiang Province, with a total capacity of 85000 tons / year. In addition, the company is also adding a new production line, which is expected to be put into operation in the middle of next year. The planned production capacity is 25000 T / A. after the expiration, the production capacity will be expanded to 110000 T / A. From the exchange of information between the company and investors, at present, the company is in full production, the visibility of orders is also good, and the production is arranged for the next quarter. As the price of wood pulp has been rising in the past two years, the company began to raise the price of products in February this year, offsetting the adverse impact of the price rise of some raw materials.

The most important area of the company’s paper carrier tape is the MLCC field. From the comparison of previous studies on Chinese porcelain materials, the overall situation of the MLCC industry is very optimistic, the demand for downstream products is strong, showing a trend of volume increase and price rise, and the demand for formula powder of Chinese porcelain materials is also significantly increased, as is the case in the first quarterly report of Jiemei technology and the information exchanged with investors. It can be seen that MLCC continues the boom of last year, and the inventory of downstream component manufacturers is generally low. Therefore, at present, the capacity utilization rate of each manufacturer is high, and the price is also rising. From last year, Sanhuan group, Fenghua High Tech and other domestic enterprises are expanding production, and the scale of production expansion is relatively large. New production capacity will be released one after another. When the stock market is stable, the incremental market may also show some performance, which will improve the market space of paper tape in disguise.

- Tape is used with paper tape, so the demand for tape is similar to that of paper tape. At present, the company’s tape is also under construction. The plan is to “expand the production of special tape for electronic component packaging with an annual output of 4.2 million volumes”, of which 2.4 million volumes of high-end tape production capacity will be newly built, and the existing 1.8 million volume production line will be relocated as a whole, so as to form a production capacity of 4.2 million volumes. At present, the construction of the new plant has been completed, the internal decoration is under way, and the relevant equipment has been scheduled and is expected to be put into operation in the middle of this year.

- In terms of plastic carrier belt, although the company has opened up the upstream raw material end and realized the integration of the industrial chain, its competitiveness has not been brought into full play due to its late start. The important application field of plastic carrier tape is the semiconductor industry. From the current situation of the company, the business development is very slow, because the proportion of plastic carrier tape in semiconductor production cost is relatively small, and the willingness of production enterprises to replace is very weak. However, with the construction and launch of the company’s new production capacity, the advantages of industrial chain integration will be very obvious. The decline of cost will make the company’s products very cost-effective. In the future, the amount of plastic tape is a matter of high probability. From the information exchanged between the company and investors, since last year, the focus of the company’s work in plastic carrier belt is to explore the semiconductor market and develop sealed test customers. At present, it has been recognized by some customers. The company announced that the growth target of plastic carrier belt is about 50% per year.

In terms of plastic carrier tape, at present, the company has 46 production lines, with a production capacity of 80 million meters / month and an annual output of nearly 1 billion meters. Two more production lines were added in the first half of this year, and six high-speed particle all-in-one machine production lines will be in place from June to July. In the second half of this year, it is planned to order another six production lines. At that time, the company will reach 60 production lines in terms of plastic carrier belt, and the planned output of raising and investing will be 1.5 billion meters / year when the IPO is completed.

【The highly anticipated release film can change the situation that the company’s product structure is too single】

Release film, also known as transfer tape, plays a very important role in Jiemei technology. It is no exaggeration to say here that the success of release membrane business will determine the future development trend of Jiemei technology. If the release membrane business can make a breakthrough in the second half of the year or the first half of next year, the company will completely change the current revenue structure and achieve rapid development. However, if the release membrane business does not develop smoothly, the company will be difficult to make great achievements in a short time.

Why do I have this view? Please look analyze it slowly.

Although Jiemei technology has quite high technical strength in the thin carrier industry, stable operation after listing and created great benefits for shareholders, we can find that the company has a very fatal weakness by looking at the company’s financial reports over the years, that is, the number of products is very small and the product structure is too single, resulting in the company’s ability to resist the risk of industry fluctuation.

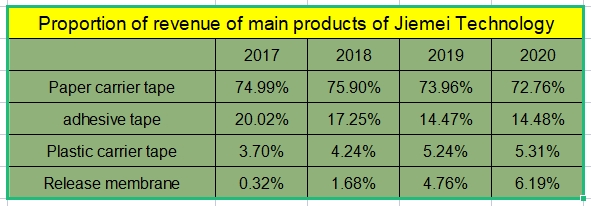

The above figure is the data chart of the proportion of Jiemei technology’s revenue since 2017, from which we can clearly find that the company’s business structure is very single, in which paper tape and adhesive tape are used as supporting products, which have accounted for 95.01%, 93.15%, 88.43% and 87.24% of the revenue respectively in the past four years. Although paper carrier tapes have great application space in the field of component packaging, at present, the main direction of their supporting use is the packaging link of MLCC. This leads to the situation that the application industry of Jiemei technology products is too single, the product structure is too single, and the application industry is too single. This situation is very passive and unhealthy. It not only makes the company face the problem of low ceiling of industry development, but also restricts the company’s ability to resist industry risks.

Therefore, in this case, the company urgently needs a product with large market space to change this short board. Although the company’s plastic carrier tape business also has the advantages of the industrial chain, the sluggish development of the downstream market restricts its growth. Finally, as a domestic scarce release film, this product bears this heavy burden.

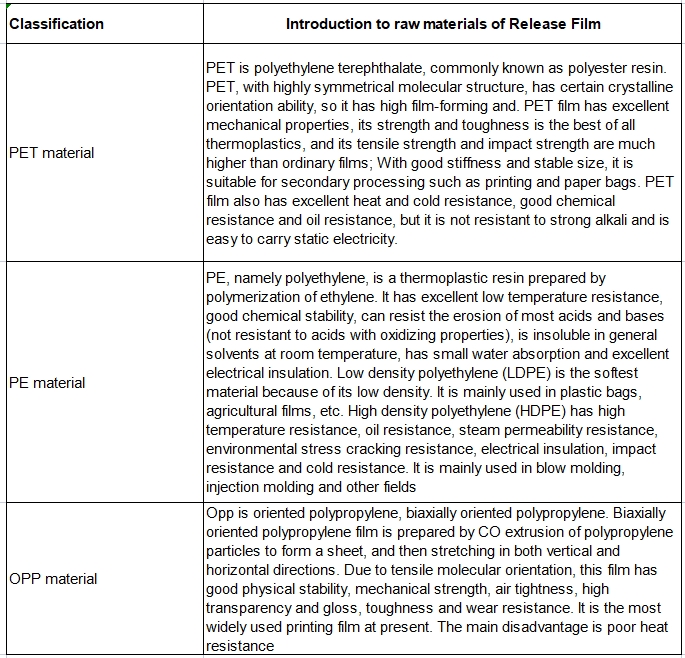

What is release film? Release film is simply understood literally as a separable film, which is very complex and difficult to understand. Anyway, the manufacturing process is difficult, and there is little that can be done in China at present. Release film can be divided into pet release film, PE release film and OPP release film according to the substrate. The three release films have their own physical characteristics and uses. The company’s release film product is pet release film. This release film is characterized by mild high tensile strength, good thermal stability, low thermal shrinkage, flat and smooth surface and good peeling performance. The following figure shows the comparison of release films of different materials:

The release film has a wide range of applications, such as laminated isolation film and protective film in printed circuit board and LED industry, raw materials of polarizer, protective layer of adhesive protective film products, etc. the release film developed by the company is mainly used in the following three aspects, namely MLCC field, polarizer field and PCB (printed circuit board) field. How is the company’s release membrane applied in these three fields? Let me briefly say that because the release film market in these three fields is still very huge, it is difficult to imagine if you don’t know how to use it.

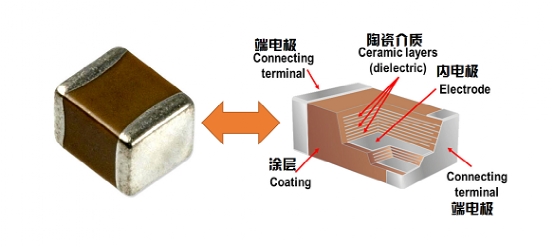

- Application in MLCC field

MLCC is a multilayer ceramic capacitor, commonly known as chip capacitor. It is a passive component with a large number of applications. The reason why it is called chip capacitor is mainly because its interior is composed of layers of ceramic dielectric sheets, and release film is used to produce this kind of ceramic sheet. During production, the silicone type agent is first coated on the surface of the release film, and the clay layer is carried during tape casting coating. MLCC usually needs to stack 300-1000 layers of ceramic media, and the stroke of each layer of ceramic media requires the same release film. Therefore, the release film is widely used in the production process of MLCC, which is the most important application field of release film.

- Application in polarizer field:

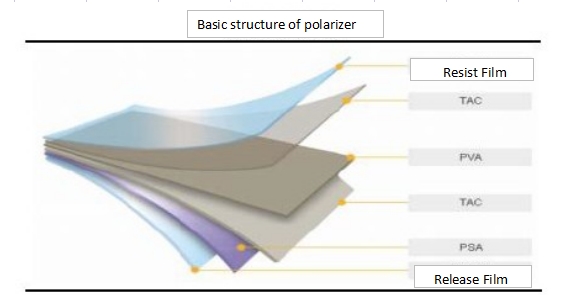

The polarizer is mainly used for the imaging of liquid crystal display. The liquid crystal consists of two polarizers close to the liquid crystal glass, with a total thickness of about 1mm.

The figure above shows the basic structure of the polarizer, in which TAC film and PVA film are the main film layers, accounting for 62% of the total cost, and release film and protective film account for about 15% of the cost.

The function of release film in polarizer is to protect PSA (pressure-sensitive adhesive). Pressure-sensitive adhesive determines the adhesion performance of polarizer and the processing performance of patch. Its performance is one of the most concerned problems of LCD (liquid crystal display) polarizer users. The function of release film is to protect this layer of pressure-sensitive adhesive. Here, there are high requirements for the performance of release film, and its peeling force determines the operability of LCD patch.

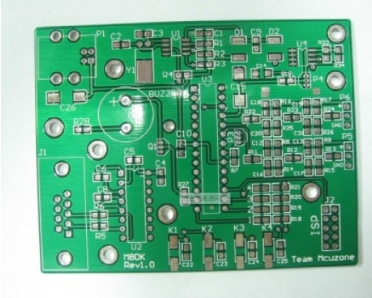

- Application in PCB field:

PCB (printed circuit board) should be seen by everyone. It is the support of electronic components and the carrier of electrical connection. It has a wide range of applications. Due to the characteristics of high temperature resistance, good release effect and no pollution in the pressing process, the release film is mainly used as protective film and laminated isolation film in the field of PCB. It is suitable for the production of rigid circuit board and flexible circuit board. The use in this field is basically universal. In short, the release film is to protect the circuit board after it is produced, and it can be easily and smoothly stripped off when using PCB. The following figure is the schematic diagram of PCB printed circuit board.

Jiemei technology’s release film is a product officially mass produced in 2018. Since 2018, the annual revenue growth has been relatively fast. At present, the release film produced by the company is mainly medium and low-end products. From the prospectus issued by the company’s convertible bonds, it can be found that the average unit price of release film showed a downward trend in the first half of 2018-2020. In addition to the decline in the price of product raw materials, it is more due to the fierce competition in the low-end release film market. At present, the price of raw materials for the production of release film has increased significantly, and the pressure faced by small and weak enterprises has risen sharply. If the company can successfully enter the trial production of the original film in October this year, it may make the company’s products competitive.

In the exchange with investors, the company said that in terms of release film, by the end of 2020, the company’s five production lines in phase I were in full production, with a production capacity of 10 million square meters / month. At the beginning of this year, the capacity of two new Korean lines has also been successfully put into operation, and the current capacity utilization rate has reached about 70%. Another Japanese machine production line is under installation and commissioning, and trial production is expected at the end of June. After the completion of the three new Japanese and Korean lines, the production capacity of the company’s eight production lines will reach 2400-2600 square meters / month. As the top priority of the release membrane industry integration, the original membrane project is being promoted as planned. In March this year, the equipment has been put in place successively, and the installation and commissioning process will take half a year. It is planned to conduct trial production in October this year, which will take 2-3 months, After that, the production capacity will increase. The company estimates that it will be able to produce the original film with medium and high-end demand by the end of this year.

Last year, the sales volume of release film of the company was 88.24 million, of which nearly 70% – 80% was the revenue realized by MLCC release film. MLCC customers are one of the advantages of the company. Due to the relationship of paper carrier, the company has accumulated a large number of high-quality customers in the MLCC field. These paper carrier customers completely overlap with the release film customers currently being developed by the company. Therefore, it can be boldly predicted that when the company has the production capacity of original film, the promotion of new products will save time and effort, However, this time is still relatively long. It is optimistic that the original film will enter mass production at the beginning of next year.

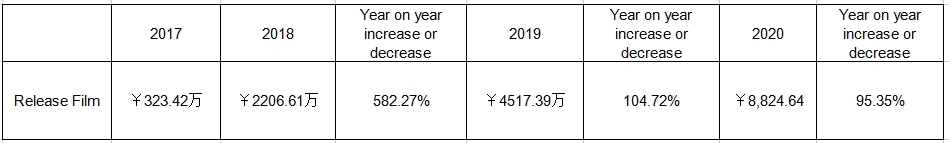

The above figure is the data chart of the company’s release film products’ revenue and revenue increase and decrease from 2017 to 2020. From the chart, we can find that the company’s release film growth rate is very fast, and the revenue has basically doubled every year since mass production in 2018.

The release film will be the biggest focus of the company this year. At present, two Korean machine production lines have been put into operation. These two lines mainly produce MLCC release film, and another Japanese machine production line will conduct trial production in June, mainly producing polarizer release film. At present, the original film of the company is not self-produced, and the original film of release film is purchased, and the gross profit margin of release film is certainly not optimistic. However, with the original film put into operation in October, the company will form the industrial chain integration of release film, and the advantages will begin to appear. The market of release film is huge, especially in the domestic downstream customers, the cost of release film accounts for a relatively high proportion, while there are few domestic production enterprises, and many customers hope to realize the nearby supporting. According to the company’s communication with investors, at present, the main customers of release film are Taiwan manufacturers and domestic customers. Once the original film production passes the certification of high-end customers, it will enter the supply system of high-end customers in Japan and South Korea.

The continuous production of release film capacity and the mass production of original film will change the current situation that the company’s product structure is too single and the application industry is too single. Moreover, the market of release film is large enough. On the basis of stabilizing the thin carrier business, the performance probability of the company will have a climbing growth.

Summary:

- The company’s customers have obvious advantages. Its customers include many well-known enterprises, including Samsung, Murata, Panasonic, Kyocera, taiyangyudian, Guoju electronics, Fenghua high tech, shunluo electronics, Huaxin technology, housheng electronics, sanlipu, Shengbo optoelectronics, Yuxing technology, sidic, Dongcai technology, etc., almost including the best quality enterprises in the field of electronic components at home and abroad, The good relationship with these enterprises makes the company have a very good business foundation. We will also find that excellent enterprises are strong enterprises. The company not only gives sufficient accounting period to downstream customers, but also accounts receivable account for a high proportion. Secondly, in order to obtain customers and maintain good customer relations, the price given by the company to each company is different, and the quotation level of competitors will be referred to when quoting. Although the gross profit of the company’s paper carrier is relatively stable, it is still in a weak position to deal with such strong customers. First, these phenomena reveal that there is certain competition in the industry, Secondly, it also shows that the business strategy of the company’s management is very flexible and sincere. This situation is also reflected in the company of guoci materials. As the same upstream raw material manufacturers, Jiemei technology and guoci materials have very sincere cooperation sincerity with downstream customers.

- The company has a leading position in the paper carrier, with a market share of more than 50%. In the view of the company’s management, the success of the paper carrier is due to the integration advantage of the industrial chain, so the company still follows this path in the follow-up plastic carrier and release film. At present, the integration advantage of the industrial chain does play incisively and vividly on the paper carrier, and it is expected that the plastic carrier and release film can also replicate this advantage.

- The company’s performance in 2020 changed from last year’s decline and achieved the best performance since listing. The first quarter was the off-season of MLCC, but the company’s first quarterly report also showed strong performance. Correspondingly, the company’s share price hit a record high on April 1 this year, which is a more positive performance. Although the share price has corrected after reaching a new high, it does not have the conditions for a sharp decline from the perspective of fundamentals, and after in-depth study, it will be found that the company is probably at the starting point of performance. Although the products and businesses of the company are not comparable with those of Chinese porcelain materials, the current position of the company is indeed a little similar to that of Chinese porcelain materials in 2015. In 2015, Chinese porcelain materials achieved mass production of zirconia, changed the company’s too single product structure, and showed significant growth in performance, Subsequently, through endogenous R & D and epitaxial M & A, it quickly enriched the product line, stepped into a variety of industries and opened up growth space. Jiemei technology is also before the mass production of heavy products. In the long run, it has very high investment value.

4.The company will focus on a lot in the next step. First, the whole industry is in a very prosperous period. According to the company’s executives, the inventory of downstream customers is low, but the market demand is strong, and the prices of downstream customers have increased for several rounds. The increase of each customer is different, from 10% + to 20% +, and some customers have even increased by 30% – 40%. This news has also been confirmed in the investor exchange of guoporcelain materials. Secondly, large domestic factories are in the stage of capacity expansion, including Sanhuan group, Fenghua high tech and other enterprises are expanding capacity, and Jiemei technology is also expanding production. These expanded capacity has improved the company’s incremental market. The third aspect is the expansion of the company’s plastic carrier and release film business. These two products have great market space, especially release film. With the completion of production capacity, this time point is getting closer and closer.

- The first disadvantage is the rise in the price of raw materials, wood pulp and plastic particles. Second, exchange losses, which are difficult to avoid for enterprises with a large proportion of exports.

——Thank Shandong capital market for providing the original manuscript